Silver

Gold

Platinum

Our EIN Application service will take 1 to 6 weeks. There is no extra cost for Non-US Residents. No SSN required. It starts at 65 USD. You are one step away from starting your application.

The expedited EIN application takes like 1 – 3 business days. There is no extra cost for Non-US Residents. You are one step away from starting your application. – ID verification is required.

We apply and submit the ITIN application as a Certified Accepted Agent. Our customers do not have to send passports. Our ITIN Application service will take 5 to 13 weeks.

E-Government LLC provides a Registered Agent service to deliver your essential business documents and remind tax duties from the State of Delaware.

E-Government LLC provides a Registered Agent service to deliver your essential business documents and remind tax duties from the State of Delaware.

We can get a short form or the same day good standing document for your business.

Physical sim card, and activated in the U.S.

Premium and super-fast DUNS approval time and one-to-one coaching.

You can authenticate any of your business documents.

Personalized Binder, Transfer Ledger, 20 Personalized Certificates, Index Tabs.

If you have an EIN and need a verification letter from the IRS.

No matter the business type, Companyincorp can help you form your new company..

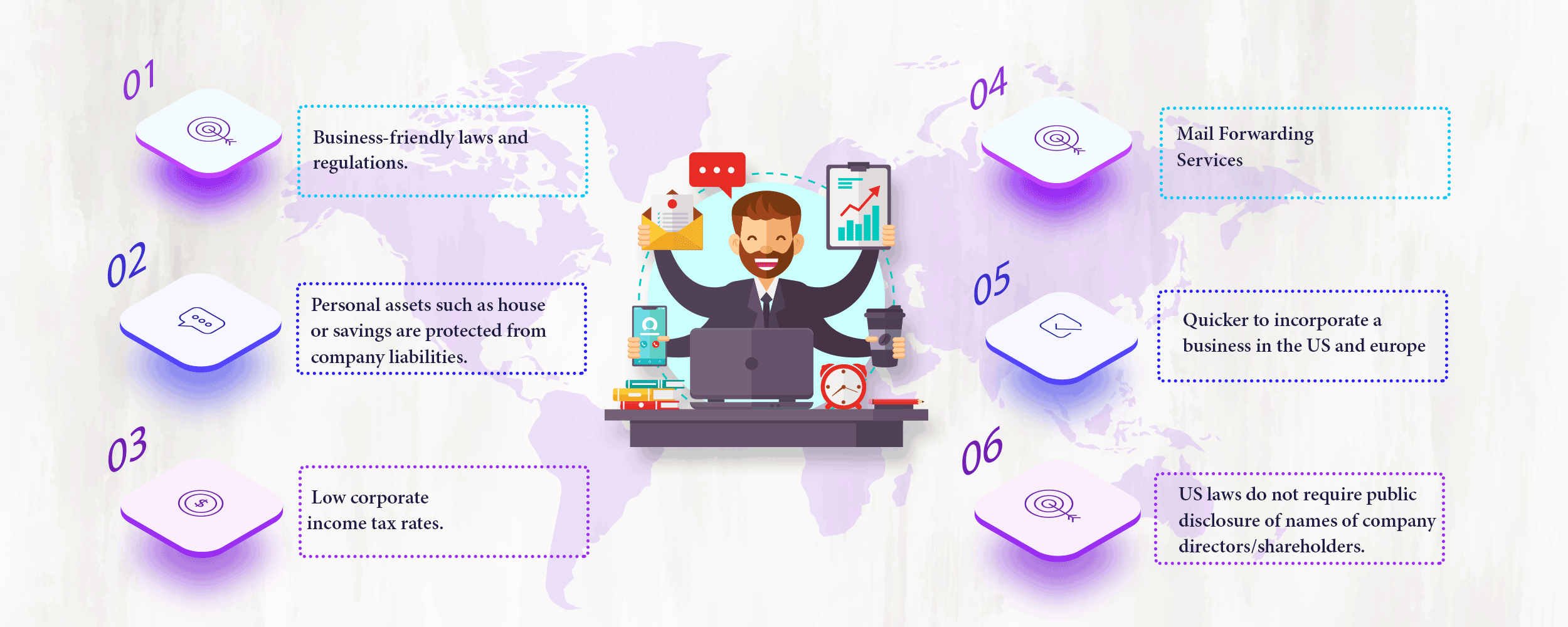

The C Corporation (C Corp) is what most people think of when they hear the word "corporation". Most large companies are formed under this structure as it offers the most tax related options for business owners. It provides the greatest level of separation between the company and its owners, and allows the company to raise capital through the issuance of publicly traded stock. However, the many formal requirements placed on C Corps prevent the structure from being the ideal choice for many smaller organizations. To learn more about forming an C Corp, click the link below.

Get Started

The Nonprofit corporation is a special type of business structure that exists to provide certain benefits to organizations that have as their main goal service to the public. Much like other formal business types, those who run Nonprofits are provided limited liability protection. To learn more about forming a Nonprofit, click the link below.

Get StartedNaming an individual as your company's registered agent is a necessary part of incorporating any business. A registered agent's primary role is to receive any formal correspondence between government agencies and your business. The Companyincorp registered agent service is designed to provide organizations of all types and sizes with an affordable and professional option to fulfill their registered agent requirements. Our registered agent services are available in all 50 states. Please visit

You can track the status of your order in My Account. Sign in and go to either the Completed Orders tab, or the Open Orders tab. From there, you'll be able to check your order status. If you see that we're about to assemble or ship, that means your business name has been approved by the state. If there's an issue, we'll let you know in your account and reach out to you.

Depending on your profession and state's licensing board, you might be required to operate as either a professional LLC or a professional corporation. To find out, please contact your state's licensing board directly. Tip: You can also find out if there's a requirement to name your business a certain way (for example, some states require dentists to include "DDS" in their business names).

There's likely a small discrepancy between the personal info on your EIN application, and the personal info on file with the IRS. For example, you might have mistyped your Social Security number. Please call us at +1 -857-626-5813 and we'll help fix the issue. For your security, we ask that you don't email us sensitive personal info.

In less than 10 minutes you fill out the form on our website and start the process of opening the company.

In most states your registration is processed in less than 3 business days. Once the process is complete, you will receive a digital copy of the document.

With EIN on hand we will send your final document package by email, in addition to detailing the next steps for your company.

As soon as we receive confirmation of your status we will send your EIN request to the IRS. If any of the company members have SSN, the process is done in less than a day. If none does, due to COVID-19 outages, the IRS may take up to 40 days to process your document.

As soon as you receive the documentation by email, you can already contact our partner banks to start opening your bank account (read details below).

FORM AN S CORPORATION (S CORP)

The S Corporation (S Corp) structure is similar to the C Corp, with a few notable differences. The most important of these differences is that S Corps are eligible for special pass through taxation status with the IRS. This allows S Corp owners to avoid double taxation on their business income. S Corps must request pass through taxation status, by filing Form 2553 with IRS after successfully incorporating. To learn more about forming an S Corp, click the link below.

Get Started